Daily Data-Driven Support for Traders Using OMX Premarket Data

For anyone who trades Swedish stocks or follows the OMX index, having access to reliable and up-to-date information before the market opens can make a big difference. The so-called “omx premarket” insights allow traders to spot trends, prepare strategies, and react faster to news that could impact their portfolio. But with the huge amount of financial news and data out there, it is easy to get overwhelmed or miss important information. This is where data-driven support steps in.

Why OMX Premarket Matters for Active Traders

Every morning, hundreds of traders check for signals that might shape the day on the Stockholm Stock Exchange. The “omx premarket” is a key tool because:

- It gives a snapshot of the major moves before trading starts.

- Traders can identify volatility triggers - for example, news affecting top OMX-listed companies or global events.

- It helps with making informed decisions about buying, selling, or holding stocks before everyone else acts.

Financial experts at Nasdaq and other sources emphasize that premarket data has a central role in active trading, especially for those managing their own risk exposure [source: Nasdaq Manila].

Problems with Old-School Market Monitoring

Many investors still use long email newsletters, multiple news tabs, or scattered Twitter feeds to gather premarket news. This method is time-consuming and can be confusing:

- Information overload: You see lots of news, but how do you know what really moves the OMX?

- Delay: By the time you found the relevant info, other traders might have acted on it already.

- Gaps: Sometimes, you miss critical updates or market-moving deals, as not every event makes headlines.

Data-Driven Support: A Better Way

Modern digital finance tools use data analysis to filter out unnecessary noise and focus on what really matters. Instead of reading dozens of pages, data-driven services give you a clear summary with only the essentials.

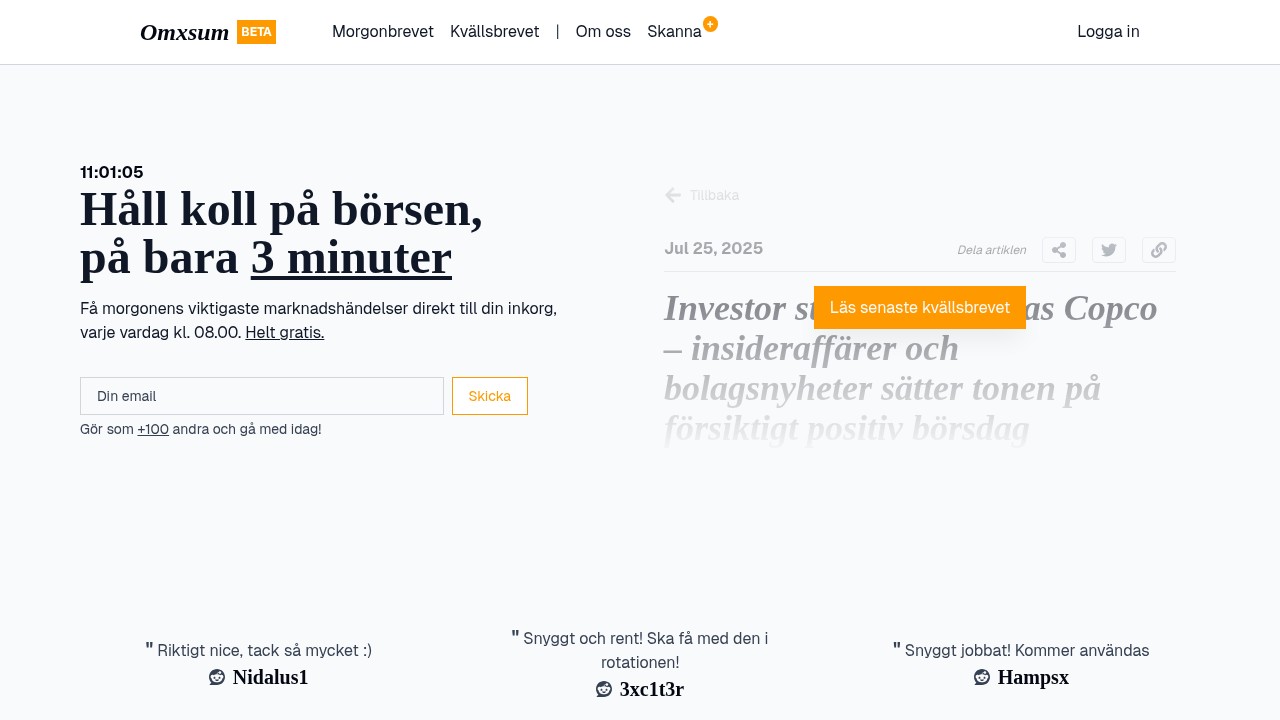

Example: Omxsum

A growing number of traders in Sweden now use services like Omxsum. Omxsum stands out by delivering targeted, algorithm-filtered news and data, directly focused on the OMX market.

Main Features:

- Morning and Evening Briefs: Brief, easy-to-read newsletters prepared by algorithms, sent every weekday before the market opens (and after it closes).

- Relevant Data Only: Instead of showing everything, the service highlights only significant press releases, insider trades, and international events with likely impact on OMX.

- Speed: In three minutes or less, users get a full overview, without hunting through blogs or finance Twitter.

- Free access: All newsletters and market scanning tools are free, with more advanced functions available to those who register.

You can subscribe and read more about how the platform works at Omxsum.com.

If you want to know more ways to make sense of market shocks, have a look at our post on Automated Selection: Making Sense of Market Crashes.

What Makes Data-Driven Support Valuable?

Strong points:

- Time saving: Just a few minutes in the morning and evening and you are ready to act.

- Less bias: Automated data collection and curation aim to remove personal bias.

- More confidence: With key facts up front, it is easier to make rational decisions instead of emotional ones.

- Better risk management: When you spot red flags early, it is possible to avoid losses or grab quick opportunities.

Weak points:

- Beta and ongoing development: As many data-driven services are still being improved, sometimes the coverage might not be 100 percent complete yet.

- No deep analysis: Highlights and summaries are great for speed, but for in-depth strategy, traders may still need to dig deeper.

How to Integrate Premarket Data into Your Routine

Practical steps for Swedish traders:

- Subscribe to algorithm-based premarket updates for the OMX.

- Use premarket data as a first filter: If a major event appears, dig deeper into company reports or industry trends.

- Combine this with technical chart analysis or other signals you trust.

- Save old newsletters or use built-in archives to compare “premarket” expectations with how actual trading unfolded later.

Want more on daily overviews via email? Check out previous posts like Marknadsinformation: Få daglig börsöversikt via e-post.

FAQ: Using OMX Premarket Data for Trading

Q: What time is OMX premarket data usually available?

Most services provide fresh data between 07:00 and 08:00, just before the Stockholm market opens.

Q: Why not just use free financial news sites?

General news sites often cover everything, which means you spend more time finding the data that is relevant for OMX trades.

Q: Does premarket data always predict the trading day?

Not always. Premarket reactions show how participants might act, but surprises after the open are possible.

Q: How can I avoid overreacting to premarket headlines?

Use premarket data as a starting point, then look for confirmation in official company reports or trusted financial analysis.

Q: Are there risks in trusting automated summaries?

Algorithms can miss context, so for big trading decisions, combine data-driven briefs with your own research or professional advice.

Final Thoughts

Getting reliable, fast “omx premarket” data is now easier with smart, algorithm-powered tools. Omxsum and similar platforms help both new and experienced traders cut out the noise and focus on moves that really matter. That means you spend less time searching and more time investing smartly. For anyone trading on the Nordics, it is worth looking into these new daily supports.