Frankfurt Wertpapierbörse: How It Shapes European Finance

Frankfurt Wertpapierbörse, known as the Frankfurt Stock Exchange, is one of Europe’s largest and oldest marketplaces for securities. Many investors and finance enthusiasts often look at Frankfurt for cues about the overall health of German and European economies. But why does the Frankfurt Stock Exchange matter for you and how are new digital tools making it easier to keep track of this busy financial hub? Let’s break it down.

What Is Frankfurt Wertpapierbörse?

Frankfurt Wertpapierbörse (FWB) is the historic and formal name of the main stock exchange in Frankfurt, Germany. Started in 1585 by local merchants for setting fair exchange rates, it has now become one of the most important exchanges in the world. According to Wikipedia, it is now operated by Deutsche Börse Group.

Basic Facts

- Founded: 1585

- Location: Frankfurt am Main, Germany

- Market Capitalization: Around USD 2.37 trillion (as of 2023)

- Main Trading Venues: Xetra (fully electronic) and traditional floor trading

- Trading Hours: 9:00 - 17:30 CET (Xetra), 8:00 - 22:00 CET (floor trading)

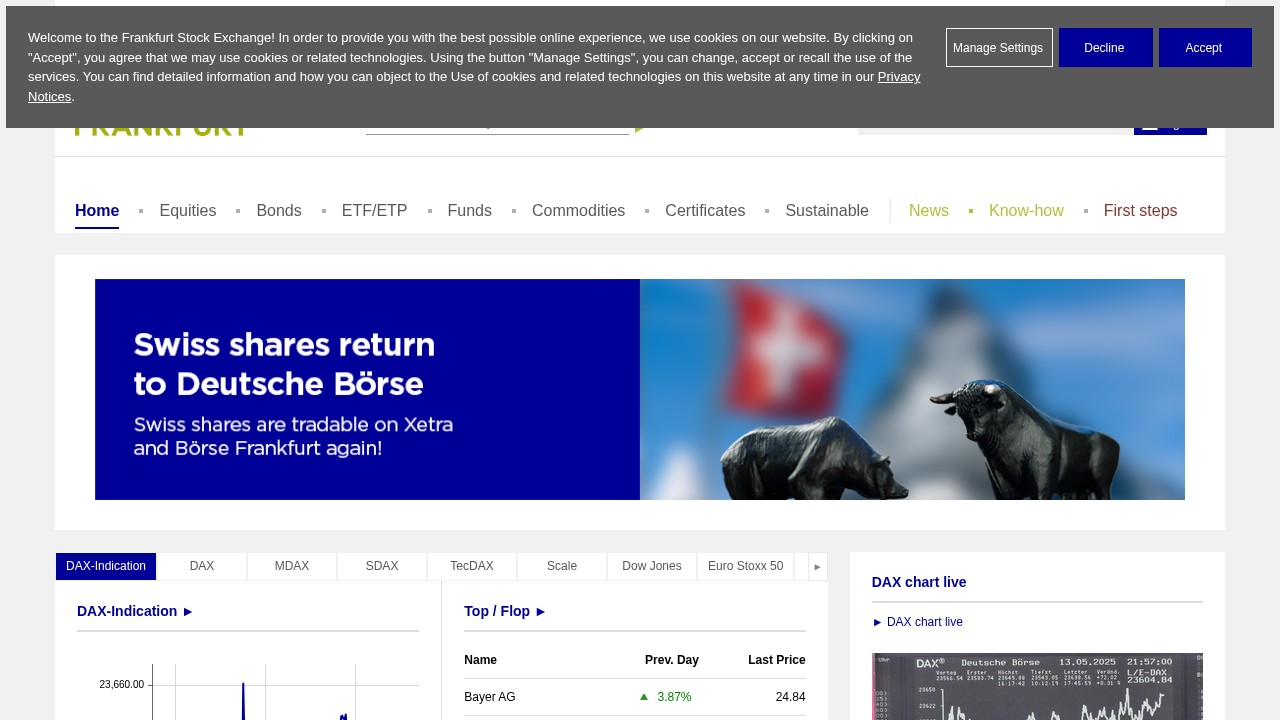

- Main Indices: DAX, MDAX, TecDAX, and others

Why Does It Matter?

Anyone interested in stocks, investing, or financial trends should know about Frankfurt Wertpapierbörse because its influence stretches way beyond Germany.

Reasons to Pay Attention

- Economic Barometer: Just like Wall Street for the United States, the Frankfurt exchange is a window into the German economy, which is the largest in Europe.

- Global Listings: Major international companies are listed here, giving it international importance.

- Regulated and Transparent: The market is overseen by several regulatory bodies, like BaFin, which helps maintain trust and efficiency (Deutsche Börse Info).

- Technological Leader: Xetra, its electronic platform, is known for high-speed and reliable trading.

Who Cares About FWB?

- Investors: Looking to diversify into European equities and follow trends

- Companies: Wanting access to capital and visibility in Europe

- Financial Media: Reporting on European economy updates

- Retail Traders: Interested in foreign stocks or ETFs

How Modern Tools Make Frankfurt Easier to Follow

In the past, tracking the fast-paced world of the Frankfurt Wertpapierbörse required scanning many sources and complex data. Now, fintech solutions like Omxsum are making it simple to stay updated.

What is Omxsum?

Omxsum is a digital service that provides short, data-driven updates on stock markets, with a primary focus on the Nordics and global financial movements. It is now in beta and updates regularly based on feedback from users.

Key Features for Market Followers:

- Morning and Evening Briefs: Fast summaries of market news, both before and after trading.

- Market Scanner: Track market changes in real time (login required).

- Easy Access: News delivered straight to your email or read on their site.

- Historic Archive: Allows you to catch up on previous days.

- Personalization: Soon, users will get tailored insights.

These kinds of updates are valuable for people interested in Frankfurt Wertpapierbörse, as Omxsum covers both global and European news, giving a quick snapshot of what is moving the markets.

Comparing: Frankfurt Wertpapierbörse vs. Digital News Tools

| Aspect | Frankfurt Wertpapierbörse | Omxsum |

|---|---|---|

| Main Role | Securities trading | Market news summarization |

| Audience | Investors, companies, brokers | All finance-interested, investors |

| Information Depth | In-depth live data, broad listings | Curated top events, short summaries |

| Access | Requires broker, many official websites | Free email/newsletter, simple sign-up |

| Language | German & English available | Primarily Swedish/English |

| Speed | Real-time, but can feel overwhelming | 3-min read, quick briefings |

Strengths and Weaknesses

Frankfurt Wertpapierbörse

Strengths:

- Long, stable history – trusted by institutions worldwide.

- Deep liquidity and many listed securities.

- Strong regulations, transparent operations.

Weaknesses:

- Information overload is common for beginners.

- English language availability is good, but much market info is in German.

- Can be hard to follow global sentiment quickly without filtering tools.

Omxsum

Strengths:

- Cuts through information overload with short, essential news.

- Totally free and easy to join.

- Covers not only Frankfurt, but also Stockholm and world markets.

Weaknesses:

- Less depth compared to full exchange-level research.

- Still beta - some features are not active yet.

- Focus is on summaries, not on direct trading.

FAQ

What is the DAX index?

The DAX is the main German stock index. It tracks the performance of 40 major companies listed on Frankfurt Wertpapierbörse.

Is the Frankfurt Stock Exchange open to foreign investors?

Yes, investors from around the world can access it through their banks or brokers.

Do I need to speak German to use the Frankfurt Börse?

No, you can use English-language versions of the exchange’s website and most trading apps.

How do I track stock prices from Frankfurt?

You can check live data on the official Börse Frankfurt website or through digital finance news services.

Can I trade directly on the exchange as an individual?

You must use a broker. The exchange itself does not offer direct access for individual traders.

For anyone wanting fast, reliable, and easy-to-read updates on financial markets including activity at Frankfurt Wertpapierbörse, tools like Omxsum fill that time-saving, information-filtering need. You get a good look at what matters and avoid market noise. And if you want deep, direct data, Frankfurt’s own digital platforms are some of the world’s most advanced. Both serve a different purpose, and together they help investors stay on top of a fast-moving world.